Why for women, money should be one of the top goals for the New Year. Part 3

Beyond money: 4 steps to Building a Financial Legacy and Crafting Your Kick A$$ Wealth Narrative

This foray into finances is not in my comfort zone. Navigating finances has never been my strong suit. I’m the one who has an ever growing stack of unopened mail. A part of me believes, if I don’t see the numbers printed in the tiny box that says “payment due”- then it doesn’t count. Over the years, I've likely squandered enough money on late charges to fund a nice trip to Italy.

The first two posts in this series left me feeling empowered. I wanted to rally women like myself who find themselves on the financial fringes. #FinancesareFeminist. I thought I was doing so well shifting my money mindset. However, that confidence took a hit when I tuned into a millennial's podcast on financial independence and early retirement with millions in the bank. The suggested strategy involved saving 20 percent of your income for the next 30 years to achieve financial freedom by your early 50s.

Wait, wha? Well this woman's advice isn’t going to work for someone who has already crossed the mid-century mark. I completely shut down. I didn't want to do any of this anymore. I wanted to ostrich. Stick my head in the sand and forget all about taking the financial world by storm.

However, this is how the narrative persists. Maybe I haven’t been left out of the conversations. Maybe I’ve excused myself from the table. Regardless, I recognize it as a responsibility I want to take on for my future self. With so many resources available, all it takes is some time and determination. I need to get over my disdain for numbers, spreadsheets and formulas. I need to tend to my financial wellness and up my money EQ and IQ. I also need to start simple.

Money Goals, Goals’ Money. These 4 steps can craft a new financial narrative.

Look at where you are.

Look at where you want to be.

Look at what you need.

Look at what you want.

Look at where you are: Assess your current financial situation.

Compile a comprehensive list of all your expenditures, leaving no item unaccounted for.

Begin with major categories such as housing, transportation, groceries, and utilities—covering all recurring living costs.

Look at the last 3 months of bank statements to get all the finer details of where your money goes. Pet supplies, yoga classes, books, cheese…the important things in life. Later, you can assess and prioritize those that bring joyful value.

Record all your sources of income. Maybe you have one full time gig. Perhaps a side hustle or part time job. These days, likely both.

Create a budget using the widely adopted 50/30/20 rule:

Allocate 50% of your income to living expenses.

Dedicate 30% to life experiences.

Reserve 20% for debt repayment, savings, and investments.

If your reality aligns more with, say, an 80/10/10 rule, don't be discouraged. The important thing is that you don’t ostrich. Remember the “energy flows where your mind goes”. It’s very important that you have a complete picture of your finances to dispel money myths and create clear financial goals.

Debt is a four letter word.

Take some deep reassuring breaths and deal with your debt. Financial wellness means that you approach your finances with courage and confidence.

Make a list of everything you owe to bills and creditors.

Write the corresponding interest rates for each.

For many, this is where shame tends to seep in. It's okay – most Americans have experienced or currently face debt. For many years, for me it looked like 90/10 split. (90 percent went to living expenses and 10 percent toward debt payment.) I had to lean on credit cards for groceries. Food is important. I don’t regret that. Years ago when starting my own small business or taking classes to further my yoga education, self-funding was my only viable option. Credit cards can give you a quick and easy personal loan, time and time again.

The big 19 point scrabble word here is- Discretionary (D2I1S1C3R1E1T1I1O1N1A1R1Y4 ) spending. Do I really need one more pair of gauchos? While I'm grateful for credit cards helping me through tight times, my goal is to reduce reliance on them. Instead, it's crucial to build an emergency fund, gradually setting aside money for unexpected life events. Otherwise for non-essentials, learn to save first, spend later.

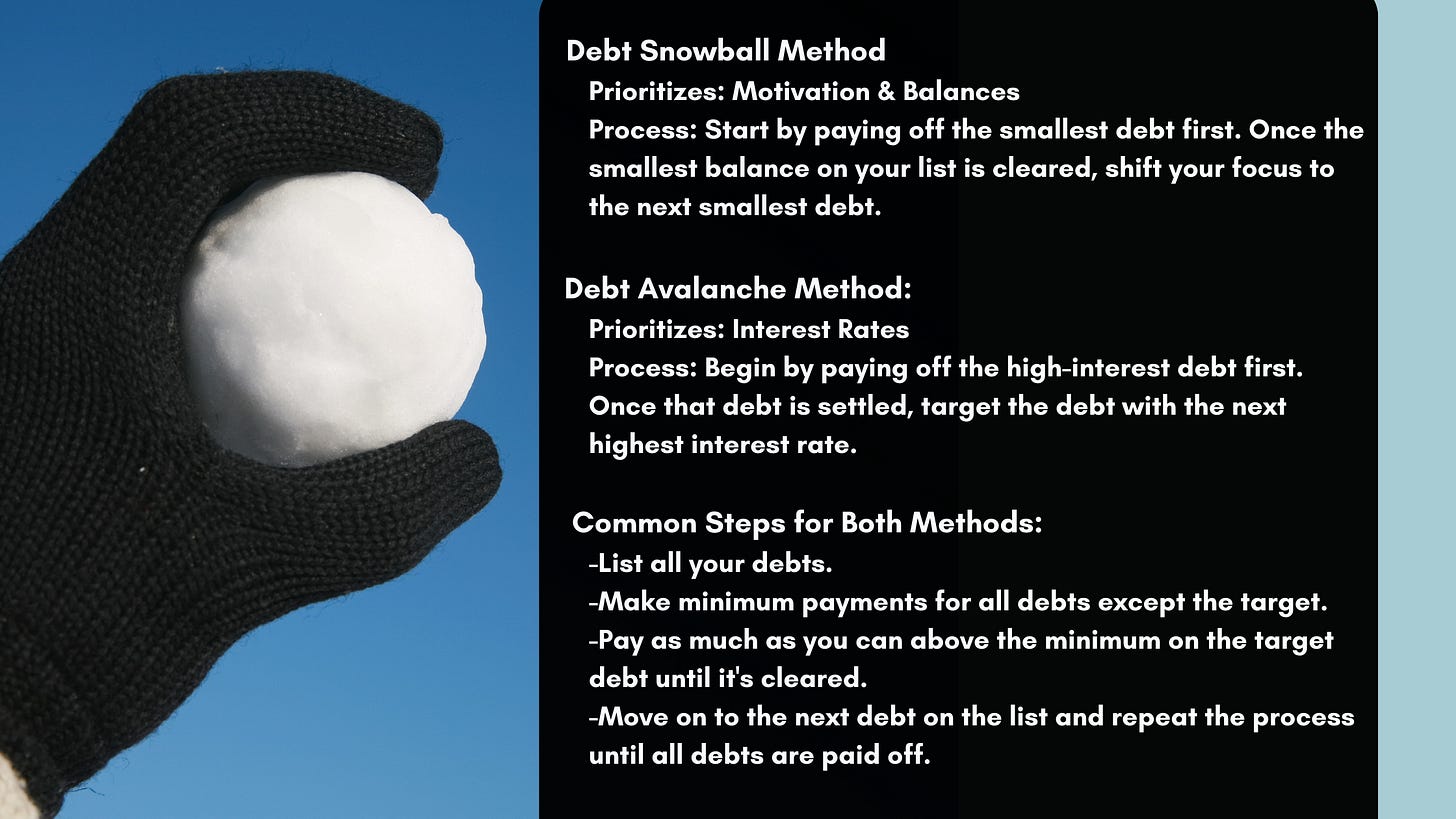

Debt Snowball vs Debt Avalanche Debt: Two approaches to ditching debt:

Common Steps for Both Methods:

List all your debts.

Make minimum payments for all debts except the target.

Pay as much as you can above the minimum on the target debt until it's cleared.

Move on to the next debt on the list and repeat the process until all debts are paid off.

Debt Avalanche Method:

Prioritizes: Motivation & Balances

Process: Start by paying off the smallest debt first. Once the smallest balance on your list is cleared, shift your focus to the next smallest debt.

Pros: Increases motivation as you eliminate smaller debts quickly. Eventually, you can concentrate on the last one or two larger debts.

Cons: May result in paying more in interest rates over time.

Debt Avalanche Method:

Prioritizes: Interest Rates

Process: Begin by paying off the high-interest debt first. Once that debt is settled, target the debt with the next highest interest rate.

Pros: Results in paying less interest over time.

Cons: The slow progress of seeing the list of debts disappear may lead to discouragement.

Look at where you want to be: Connect your financial goals with your life aspirations.

Reflect on your life goals and incorporate them into your over-all financial plan. Allocate funds toward your short term goal and a savings plan for long term goals. Invest in yourself. Be realistic about what it will cost you to bring each goal to its success. Get clear on both money goals and goal money.

Short term Budget: If you want to start an online business, know that there are costs to launch a website. Or as another example, if your goal is to focus on your wellness this season, make a list of what that includes and set an allowance to direct toward each item on the list.

Yoga Membership

Organic Food

Monthly massage

Weekly facial: a list of products you’ll use at home.

Long term Savings: What is left for you to set aside? Is there a way to make your money work for you by resting it in a CD or investing some of it? OR do you have a specific purchase you want to make, like a car, house down payment, or inflatable hot tub?

When you come up with an amount you can devote to saving or investing, automate it. Send this amount to your savings or investment accounts automatically each month.

Look at what you want: Examine your wants.

We all have aspirations that resonate deeply within us, a vision for the life we wish to lead. It’s common to hold idealized versions of our own wealth and success and imagine how we want it to look, and feel.

This is where you can ditch the spread sheet for a vision board for a minute. Let yourself go there. Without judgment, make a list of all the things you want. Next, assign a price to each of these desires. Calculate the monthly earnings required to attain everything on your list.

Reflect on the number of hours you would need to work. Ask yourself if committing to a 60-hour workweek is it worth the cost of acquiring these desires. There are great trade-off between working long hours and getting your most coveted wants. When it comes to spending the most valuable question is why? Why do you want something? How will it serve you and what might it deny you?

Look at what you need: Prioritize your needs.

Avoid overwhelm, make a list of priorities to address one by one. What spending, saving or investing would free you of worry? Inspire a feeling of financial flow and freedom as you learn to discern the difference between a want and a need. What is the value of each expenditure - - does it truly fulfill you on a meaningful level?

Money Mogul, Morgan Housel, author of "The Psychology of Money, shares " Many individuals express a desire to be millionaires when, in reality, they aspire to spend a million dollars.”

This is when understanding your "why" becomes crucial. Why do you seek wealth? Is it for life experiences like trips, dinners with friends, or a ride on a snowmobile? Or do you aim to accumulate possessions like a snowmobile, a house, or a car? Clarify whether your priorities are in living or owning? What does financial freedom signify to you? Is it the ability to purchase whatever you desire, the freedom to work for yourself, or the flexibility to follow your preferred schedule?

There’s an equilibrium we have to maintain between income, spending, wants, and needs. The real choice is whether we increase our income or reduce our spending. The decisions are yours to make. You have the power to manage your money and allocate portions of your income to different facets of your life. However, the first step is gaining a precise understanding of what holds true importance for you. Determine your why and align a budget in the direction of your dreams. Let the ultimate aim be to get to the end of our life with the wealth of health and a unique collection of rich memories.

The Real Real

The 90/10 split is a very real place for so many people. It is easy to feel trapped in the debt cycle. Navigating this system can be overwhelming. Don't hesitate to ask for help. Seek out non-profit organizations that provide free financial advice. Regardless of your situation, tend to your finances. Don't let financial stress compromise your health or steal your joy.

Here’s a list of resources to check out. This is a quick google search. I haven’t had the opportunity to vet each one myself, but these come recommended. I do like Savvy Ladies, however.

https://www.savvyladies.org/mission/

https://operationhope.org/

https://moneythink.org/

https://www.jumpstart.org/

https://www.clearpoint.org/

https://www.nfcc.org/

Life Mandala Dharma Days immersion coming this Spring for all paid subscribers!